What Is Insurance?

Insurance is a contract, represented by a policy, in which a policyholder receives financial protection or reimbursement against losses from an insurance company.

The company pools clients’ risks to make payments more affordable for the insured. Most people have some insurance: for their car, their house, their healthcare, or their life.

Key Takeaways

- Insurance is a contract (policy) in which an insurer indemnifies another against losses from specific contingencies or perils.

- There are many types of insurance policies. Life, health, homeowners, and auto are among the most common forms of insurance.

- The core components that make up most insurance policies are the premium, deductible, and policy limits.

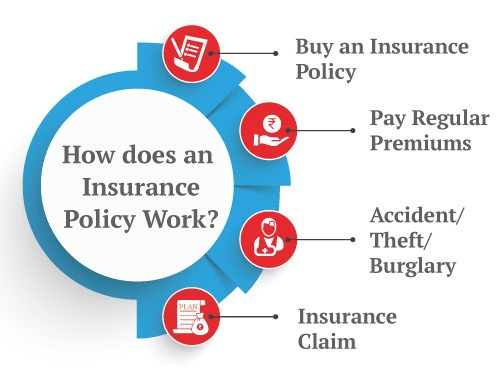

How Insurance Works

Many insurance policy types are available, and virtually any individual or business can find an insurance company willing to insure them—for a price. Common personal insurance policy types are auto, health, homeowners, and life insurance.

Most individuals in the United States have at least one of these types of insurance, and car insurance is required by state law.

Businesses obtain insurance policies for field-specific risks:

- For example, a fast-food restaurant’s policy may cover an employee’s injuries from cooking with a deep fryer.

- Medical malpractice insurance covers injury- or death-related liability claims resulting from the health care provider’s negligence or malpractice.

Most insurance is regulated at the state level.

Specific insurance policies include:

- Kidnap, ransom and extortion insurance (K&R)

- Identity theft insurance

- Wedding liability and cancellation insurance

Insurance Policy Components

Understanding how insurance works can help you choose a policy. For instance, comprehensive coverage may or may not be the right type of auto insurance for you. Three components of any insurance type are the premium, policy limit, and deductible.

Premium

- A policy’s premium is its price, typically a monthly cost.

- Factors affecting premiums vary by type of insurance, such as age, location, and claims history.

Policy Limit

- The policy limit is the maximum amount an insurer will pay for a covered loss under a policy.

- Higher limits typically carry higher premiums.

Deductible

- The deductible is a specific amount you pay out of pocket before the insurer pays a claim.

- Policies with high deductibles are typically less expensive because they result in fewer small claims.

Types of Insurance

There are many different types of insurance. Let’s look at the most important.

Health Insurance

- Helps cover routine and emergency medical care costs, often with the option to add vision and dental services separately.

- May be purchased from various sources, including insurance companies, employers, or federal programs like Medicare and Medicaid.

Home Insurance

- Protects your home, other property structures, and personal possessions against natural disasters, unexpected damage, theft, and vandalism.

- Lender or landlord may require coverage.

Auto Insurance

- Helps pay claims if you injure or damage someone else’s property in a car accident, or for accident-related repairs on your vehicle.

- Required for leased or financed vehicles.

Life Insurance

- Guarantees a sum of money to beneficiaries if you die.

- Two main types: term life insurance and permanent life insurance.

Travel Insurance

- Covers costs and losses associated with traveling, including trip cancellations or delays, emergency health care, and damaged baggage.

FAQ

What Is Insurance?

Insurance is a way to manage financial risks. When you buy insurance, you purchase protection against unexpected financial losses. The insurance company pays you or someone you choose if something bad occurs.

Why Is Insurance Important?

Insurance helps protect you, your family, and your assets against unexpected costs and risks. It offers peace of mind regarding unforeseen financial risks.

Is Insurance an Asset?

Depending on the type of life insurance policy, it could be considered a financial asset because it can build cash value or be converted into cash.

The Bottom Line

Insurance helps protect you and your family against unexpected financial costs and losses. It provides security against expensive lawsuits, injuries, damages, and even total losses of assets like your car or home.

Choose the right insurance based on your goals and financial situation.